Your opinion is important to us!

Help us improve by filling our quick survey

8

Mins Read

|

September 29, 2025

In today's volatile economic climate, financial advisors are under increasing pressure to find assets that offer both stability and growth. Traditional portfolios of stocks and bonds are facing unprecedented challenges, pushing wealth managers to look beyond the usual for sources of diversification and inflation hedging. While real estate and precious metals are common choices, a more refined and historically resilient asset class is quietly gaining traction: investment-grade sapphires.

For the discerning investor, sapphires are more than just beautiful objects; they are tangible, portable stores of value with a compelling financial narrative. But moving from appreciation to allocation requires a deeper understanding of the market's unique dynamics. This guide provides the framework for evaluating sapphires not as collectibles, but as a sophisticated component of a modern wealth management strategy.

The argument for including sapphires in a diversified portfolio rests on a foundation of scarcity, durability, and proven performance. Unlike financial instruments created from code or contracts, an investment-grade sapphire’s value is intrinsic and globally recognized.

To truly understand their role, sapphires must be benchmarked against other alternative and traditional assets. Each asset class serves a different purpose, and sapphires occupy a unique niche that balances performance with passion.

.png)

Gold is the traditional safe-haven asset, prized for its liquidity and stability. Sapphires, while less liquid, offer greater potential for capital appreciation driven by rarity and individual characteristics. Where gold is a commodity, each fine sapphire is unique, meaning an exceptional stone can command a premium far beyond its weight.

When considering jewelry as an investment, sapphires offer distinct advantages over assets like fine art, classic cars, or wine. They have demonstrated comparable annual returns (5-10% for art/cars, 4-9% for wine) but come with significantly lower carrying costs. There is no need for specialized climate-controlled storage or expensive maintenance. Furthermore, the ongoing costs for sapphires—insurance (0.5-1% annually) and storage (1.5-2.5% annually)—are predictable and manageable.

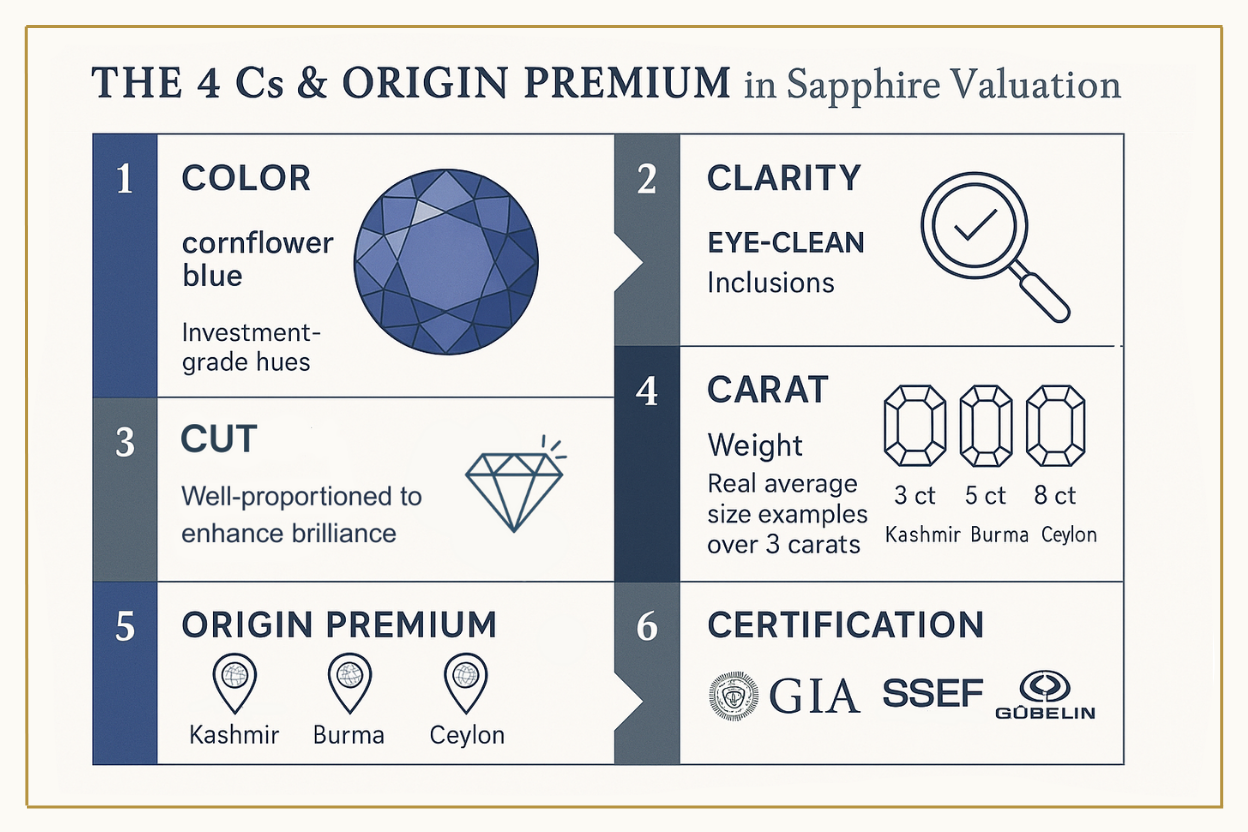

Not all sapphires qualify as investment-grade. Making an informed decision requires looking beyond a stone's beauty and applying rigorous financial and gemological criteria. Misunderstanding these factors is a primary source of loss in the gemstone market, where improper authentication can contribute to 15-20% of investment failures.

While the traditional "4 Cs" (Color, Clarity, Cut, Carat) are a starting point, investors must apply a more critical lens:

Two factors critically impact a sapphire’s value:

An investment in a sapphire is an investment in its documentation. An independent report from a world-renowned gemological laboratory like the SSEF, Gübelin, or GIA is essential. This certificate validates the stone's identity, origin, and treatment status, providing the transparent, third-party verification needed to recognize genuine gemstones and secure the asset's value.

Integrating sapphires into a client's portfolio should be a deliberate, strategic decision aligned with their risk tolerance and long-term goals. Due to their relative illiquidity, they are best suited for investors with a longer time horizon.

A common allocation for gemstones as alternative assets in wealth management ranges from 1-5% of a total portfolio. This modest allocation is enough to provide meaningful diversification and a hedge against inflation without overexposing the client to liquidity risks. The primary role of sapphires is to reduce correlation with traditional financial markets, providing a source of stability during economic downturns.

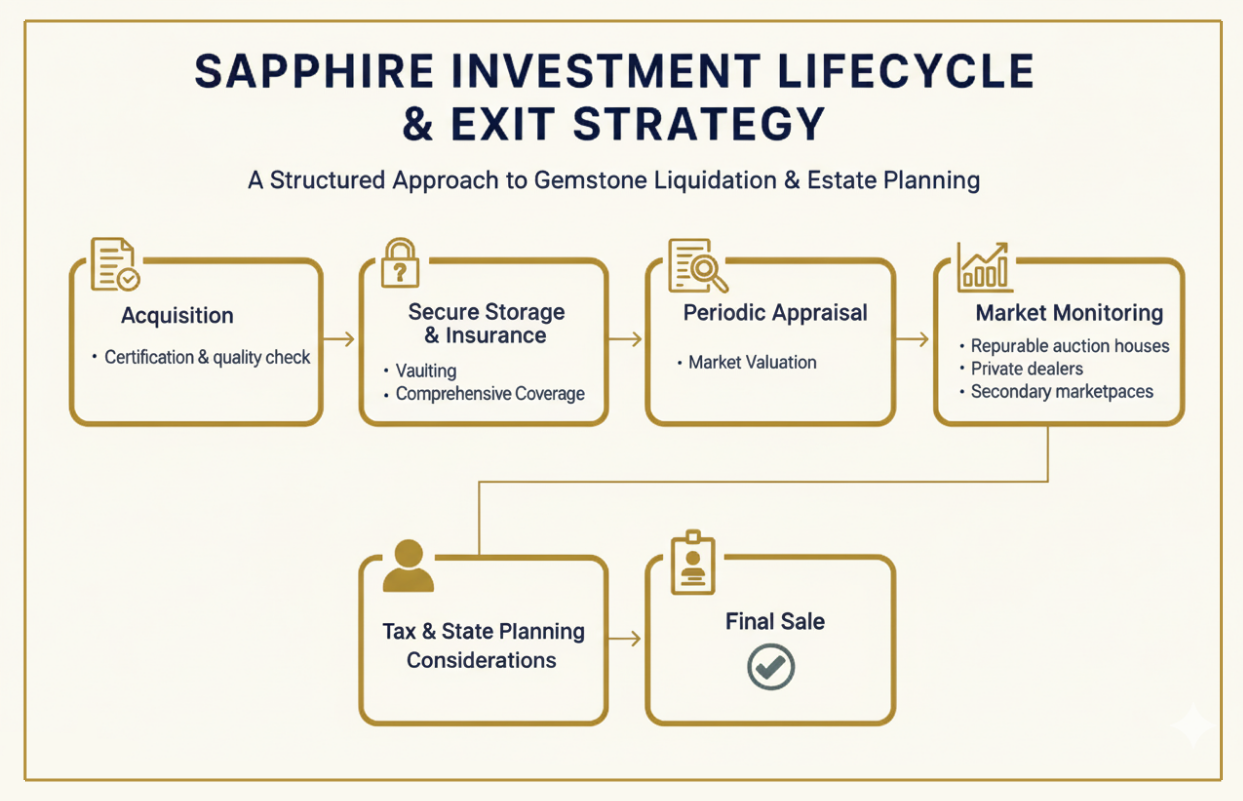

A successful sapphire investment strategy requires a clear plan for the entire asset lifecycle, from acquisition to liquidation. Addressing these practicalities upfront builds confidence and mitigates risk.

Sapphires are not as liquid as stocks or gold. Wealth managers should plan for a liquidation period of 3–6 months for high-quality stones. Reputable exit channels include major auction houses (like Christie's or Sotheby's), private sales through trusted dealers, or consignment with specialized jewelers. Developing a clear plan for selling gemstones is a crucial part of the initial investment thesis.

In the United States, gemstones are classified as "collectibles" and are subject to a long-term capital gains tax capped at 28%, significantly higher than the 15-20% rate for most other investments. Additionally, gains may be subject to the 3.8% Net Investment Income Tax (NIIT). Advisors must factor these rates into performance projections and explore tax-efficient strategies with a qualified professional.

Sapphires are uniquely suited for intergenerational wealth transfer. Their durability and portability make them simple to include in wills and trusts. Regular, independent appraisals are critical to ensure a fair market value is established for estate purposes, simplifying the process for heirs and ensuring a smooth transfer of wealth.

What is a realistic holding period for a sapphire investment?

A holding period of 5-10 years or more is recommended. This allows sufficient time for the market to appreciate and helps absorb transaction costs associated with buying and selling. Sapphires are not suitable for short-term speculation.

How do I accurately value a sapphire in a client's portfolio?

Valuation should be based on an updated appraisal from a certified independent appraiser every 2-3 years. The value should reflect current market comparables for stones of similar quality, origin, and size, supported by its original gemological certificate.

What are the biggest mistakes investors make with gemstones?

The most common errors include purchasing without a top-tier independent certificate, overpaying due to a lack of market knowledge, and failing to account for the costs of insurance and secure storage. Partnering with a trusted, ethical source is the best way to avoid these pitfalls. There are many important facts about sapphires that can help inform a purchase.

Investment-grade sapphires offer a compelling blend of historical prestige, tangible security, and potential for capital growth. For clients seeking to diversify beyond conventional assets, they represent an opportunity to add a resilient and uncorrelated asset to their holdings.

By understanding the key criteria of quality, insisting on transparent and ethical sourcing, and planning for the entire investment lifecycle, wealth managers can confidently guide their clients in harnessing the enduring value of fine sapphires.

To explore investment-grade sapphires sourced directly and ethically from the world’s finest mines, we invite you to consult with our specialists. Let us help you find the right tangible assets to strengthen your clients' portfolios.

Sign up to our newsletter now and get it directly to your mailbox.

CEYLONS | MUNICH stands for the finest Ceylon sapphires. A brand committed to responsible mining of Sri Lankan gemstones obtained in an ethical manner.