Your opinion is important to us!

Help us improve by filling our quick survey

Mins Read

|

October 9, 2025

In a world of market volatility and inflationary pressure, sophisticated investors and wealth managers are increasingly looking beyond traditional stocks and bonds. You're likely evaluating every option to build a resilient portfolio—one that not only grows but also preserves wealth. While assets like real estate and fine art are common considerations, investment-grade sapphires present a compelling, yet often misunderstood, opportunity for diversification and long-term appreciation.

But how do you evaluate a tangible asset like a sapphire with the same analytical rigor you apply to a financial security? This guide moves beyond surface-level advice to provide the comparative frameworks and strategic insights you need at this critical evaluation stage. We'll explore how these rare gems function as a powerful store of value and a hedge against economic uncertainty, empowering you to make a confident and informed decision.

Unlike stocks or bonds, which represent a claim on future earnings, an investment-grade sapphire is a real, tangible asset with intrinsic value. This physical nature provides a unique layer of security in a diversified portfolio. Historically, hard assets have demonstrated resilience during periods of economic turbulence.

The investment case for sapphires is built on a simple yet powerful economic principle: scarcity. While demand for high-quality sapphires grows at an estimated 15-20% annually, production increases by only about 10% per year. This fundamental supply-demand imbalance creates a natural upward pressure on value, offering a compelling potential for long-term capital appreciation.

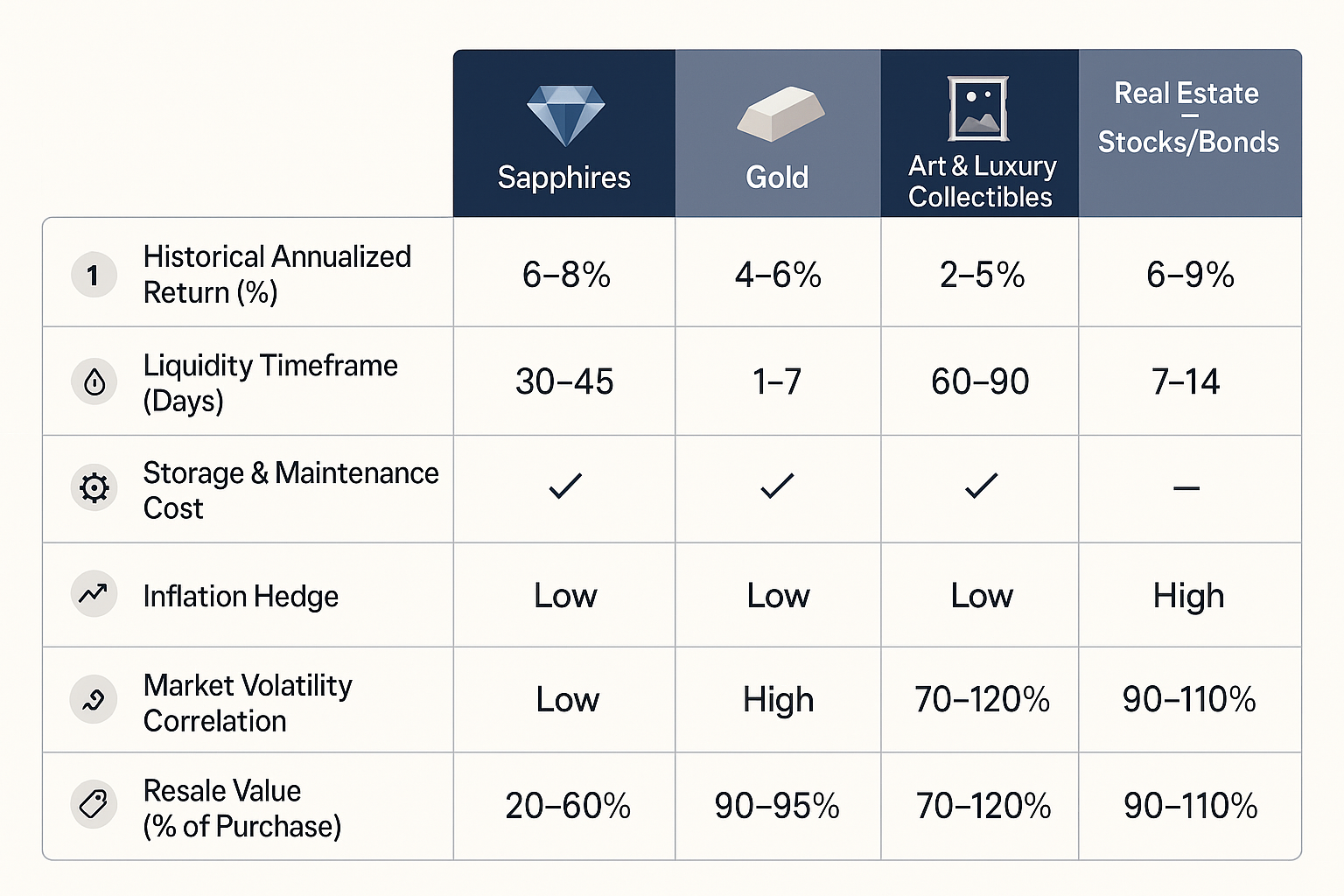

To truly understand the role sapphires can play, you need to compare them directly against other alternative assets. Each has its own profile of benefits, risks, and responsibilities.

Gold is the traditional safe-haven asset, prized for its liquidity. However, sapphires offer distinct advantages. While gold is a commodity, every investment-grade sapphire is unique, offering greater potential for exponential value increase based on its individual characteristics. Top-tier Kashmir sapphires, for example, have seen prices appreciate by over 800% in the last 40 years. Furthermore, sapphires offer unparalleled value concentration, making them discreet and easy to transport and store securely.

The art market can offer spectacular returns, but it is highly subjective and driven by trends and tastes. Sapphire valuation, by contrast, is grounded in objective gemological science. While beauty is a factor, an investment-grade stone's value is determined by measurable criteria certified by world-renowned laboratories. This objectivity reduces the speculative risk associated with art and other collectibles.

Real estate provides the potential for rental income, but it comes with significant carrying costs: taxes, maintenance, insurance, and management fees. Sapphires have virtually no carrying costs. They are also far more liquid than property, which can take months or even years to sell. While finding a specialized buyer for a sapphire may take 30-45 days for optimal pricing, this is a fraction of the time required for a typical real estate transaction.

For jewelry, the "4Cs" (Carat, Cut, Clarity, Color) are a useful starting point. For investors, they are merely the first chapter. True investment value is unlocked by understanding the nuanced factors that create rarity and desirability. Discerning the subtle differences between gemstones is a key component of a successful colored gemstone investment strategy.

Integrating sapphires into a portfolio requires a disciplined strategy, not just a one-off purchase. For many high-net-worth individuals, an allocation of 5-10% of their alternative asset holdings to hard assets like gemstones provides a meaningful diversification benefit without overexposure.

A common approach involves:

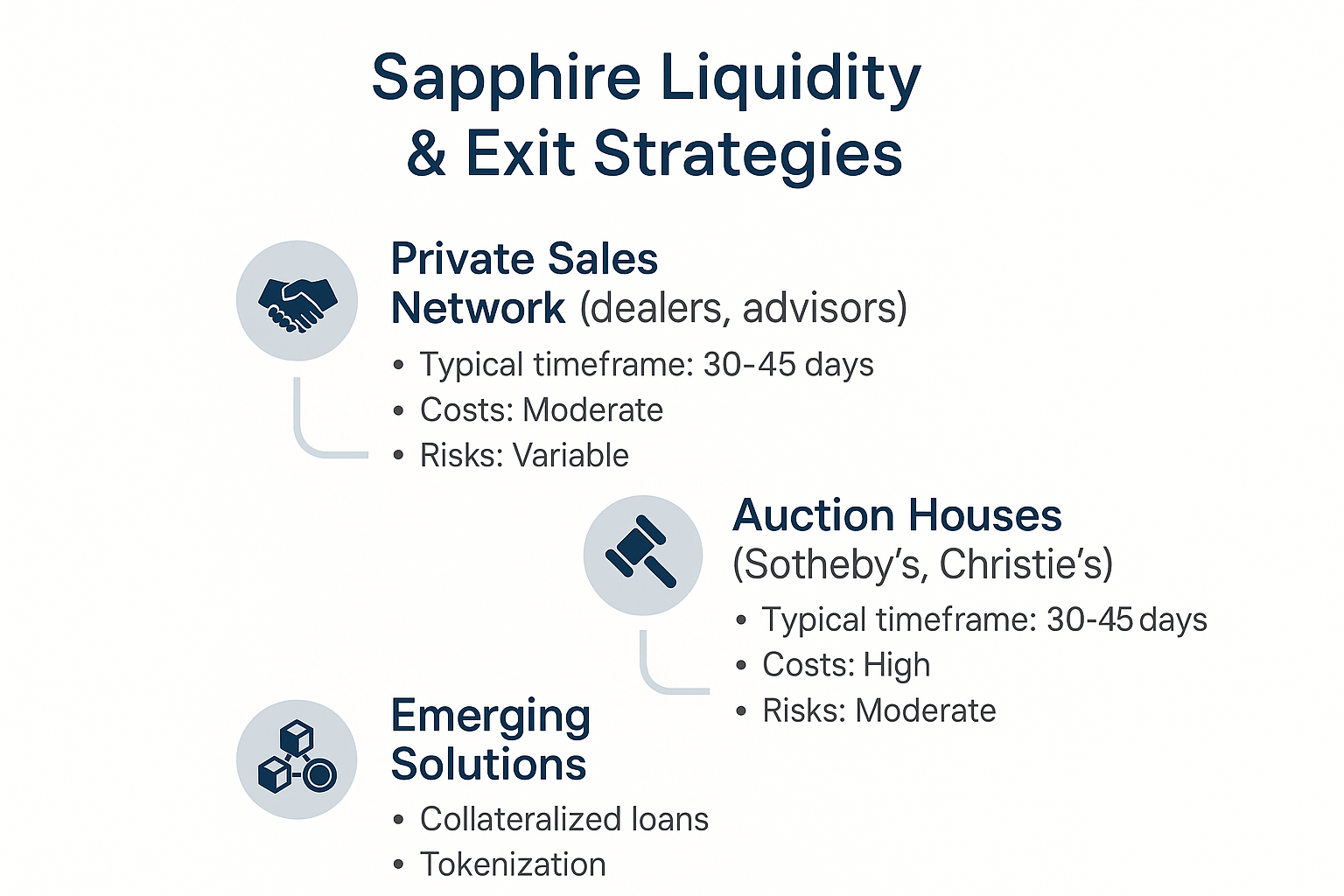

A common concern for investors is liquidity. While sapphires are not as instantly convertible as gold, the market is far from illiquid. A clear understanding of your exit pathways from the outset is a crucial part of the investment process.

For wealth management, understanding the tax and estate implications of any asset is non-negotiable. In many jurisdictions, gemstones are classified as "collectibles," which can have a different tax treatment than other investments.

In the U.S., for instance, long-term capital gains on collectibles are taxed at a maximum federal rate of 28%, higher than the rate for stocks. However, strategies involving trusts and gifting can be used for efficient wealth transfer. It is essential to consult with a qualified tax advisor to structure your holdings in a way that aligns with your overall financial and estate planning goals. Considering gemstones as alternative assets in wealth management requires this level of professional diligence.

The greatest risk in the gemstone market is not volatility but a lack of transparency. Mitigating this risk comes down to one principle: know your source. Working with suppliers who offer direct-from-mine traceability and a verifiable chain of custody is paramount.

Today, modern investors are also placing a premium on ethical sapphires and other gems that are sourced with respect for both the environment and the mining communities. This commitment to sustainability is not just a moral imperative; it is becoming a significant value driver, as discerning collectors increasingly demand fully transparent and ethical gemstones.

Are sapphires truly a good investment?

Yes, for the right investor, they can be. High-quality, untreated sapphires have a multi-decade track record of significant price appreciation, with annualized returns estimated at 6-8%. They serve as an excellent portfolio diversifier and inflation hedge. However, they are a long-term asset and require expert guidance for acquisition and liquidation.

How can I be sure a sapphire is authentic and high-quality?

Your primary tool for verification is an independent gemological report from a top-tier lab like Gübelin, SSEF, or GIA. This, combined with purchasing from a reputable source with a transparent supply chain, provides the highest level of confidence in the stone's quality, origin, and treatment status.

What is the minimum investment for an investment-grade sapphire?

While prices vary greatly, a true investment-grade sapphire—typically an unheated stone of fine color and clarity—generally starts in the five-figure range. The most significant appreciation potential is often found in stones valued at $50,000 and above, as this is where true rarity begins.

How does the resale value of a sapphire compare to its purchase price?

It's important to distinguish between retail jewelry markup and investment value. The resale value for mass-market jewelry is often a fraction of its retail price. However, when you purchase a top-tier, certified sapphire at a fair market price close to the source, the goal is for its value to appreciate over time, allowing for a profitable exit through specialized channels.

Investment-grade sapphires offer a unique combination of rarity, durability, and beauty, backed by a history of strong value retention and appreciation. For the investor seeking to build a truly diversified and resilient portfolio, they represent a tangible, private, and portable store of wealth for generations to come.

Making a confident investment requires deep knowledge and a trusted partner. To learn more about integrating these exceptional assets into your wealth strategy, we invite you to explore our curated collection or speak with one of our specialists.

Sign up to our newsletter now and get it directly to your mailbox.

CEYLONS | MUNICH stands for the finest Ceylon sapphires. A brand committed to responsible mining of Sri Lankan gemstones obtained in an ethical manner.